Michael Parkin, Economics, 7th edition 2005 Chapter

9/25

Growth Theories

A.

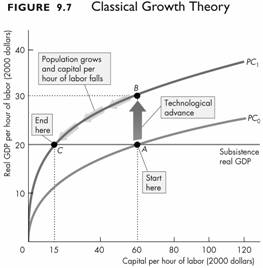

Classical Growth Theory

1. Classical economists lived in a time and place where

population growth was rapid (it has been faster since) and income per person had

started to rise.

2.

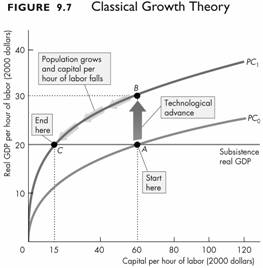

Classical growth theory is the view that real GDP growth is temporary

and that when real GDP per person rises above the subsistence level, a

population explosion eventually brings real GDP per person back to the

subsistence level.

3. The classical model unfolds as:

a) Advances in technology increase labor productivity

and the demand for labor increases.

b) The increase in the demand for labor raises the real

wage rate.

c) The rise in the real wage rate boosts the population

growth rate, which then increases the supply of labor.

d) The increase in the supply of labor lowers the real

wage rate.

e)

The supply of labor continues to increase until the real wage rate has been

driven back to the subsistence

real wage rate, which is the minimum real wage rate necessary to

maintain life. At this real wage rate, both population growth and economic

growth stop. Figure 9.7 illustrates this process using a productivity curve.

e)

The supply of labor continues to increase until the real wage rate has been

driven back to the subsistence

real wage rate, which is the minimum real wage rate necessary to

maintain life. At this real wage rate, both population growth and economic

growth stop. Figure 9.7 illustrates this process using a productivity curve.

4. Contrary to the assumption of the classical theory,

the historical evidence shows that population growth rate is not a simple

function of income, and population does not always grow sufficiently to drive

average incomes back down to subsistence levels.

B.

Neoclassical Growth Theory

1. Neoclassical growth theory was developed in the

1950s, when technology was advancing and economic growth occurring.

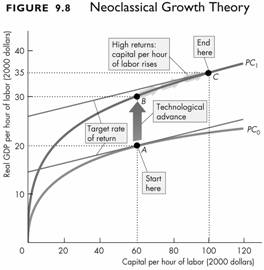

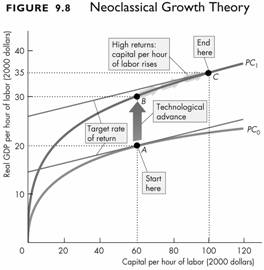

2.

Neoclassical growth theory is the proposition that that real GDP per

person grows because technological change induces a level of saving and

investment that makes capital per hour grow.

3. The precursor to neoclassical growth theory was

better understanding of the economic influences on birth and death rates.

a) A key determinant of birth rates is the opportunity

cost of women’s time; higher incomes and modern living conditions raise the cost

of having children.

b) Higher incomes also greatly lower infant and child

mortality.

c) These two forces tend to offset each other, and

neoclassical growth theory assumes that the population growth rate is

independent of the economic growth rate.

4. The neoclassical model unfolds as:

a) Technological change occurs as the result of chance

or luck.

b) An increase in technology raises the profit from

investment, so investment increases. The increase in investment demand raises

the real interest rate and also increases the equilibrium quantity of

investment.

c) The increase in investment increases the capital

stock. The faster the capital stock grows, the more rapid is economic growth per

person.

d) As long as the real interest rate exceeds people’s

target interest rate, saving is sufficient to increase capital per hour of

labor.

e) As the capital stock increases, the real interest

rate falls.

f)

Growth continues as long as technological change keeps the real interest rate

above the target rate of return.

f)

Growth continues as long as technological change keeps the real interest rate

above the target rate of return.

g) Eventually technological change stops and the

capital stock increases sufficiently to drive the interest rate back to its

target level. At this point, economic growth stops and only enough investment is

made to replace depreciated capital. Figure 9.8 illustrates the neoclassical

growth model using a productivity curve.

5. A drawback to the neoclassical growth theory is that

it predicts that all countries converge to the same level of GDP per person.

C. New

Growth Theory

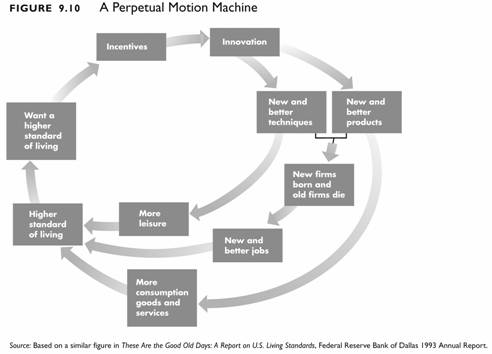

1. The

new growth theory

holds that real GDP per person grows because of the choices that people make in

the pursuit of profit and that growth can persist indefinitely.

2. Two facts about market economies are important:

a) Discoveries result from people’s choices.

b) Discoveries give the discoverer the opportunity to

temporarily earn large economic profits, but competition destroys those profits.

3. Two further facts play a key role:

a) Discoveries of new technology can be used by many

people at the same time, that is they are a public capital good.

b) Knowledge itself is not subject to diminishing

returns, and physical activities (firms) can be replicated throughout the

economy.

4.

The fact that physical activities can be replicated is crucial. It means that

for the economy as a whole, the return from capital does not diminish as

more capital is acquired, so long as knowledge and human capital continue to

advance and add to productivity. So once the real interest exceeds the target

rate of return, there is no force to drive it back down to the target rate of

return.

4.

The fact that physical activities can be replicated is crucial. It means that

for the economy as a whole, the return from capital does not diminish as

more capital is acquired, so long as knowledge and human capital continue to

advance and add to productivity. So once the real interest exceeds the target

rate of return, there is no force to drive it back down to the target rate of

return.

5. As long as the return from capital exceeds the

target rate of return, more capital is acquired and economic growth persists.

Capital constantly increases and economic growth is perpetual.

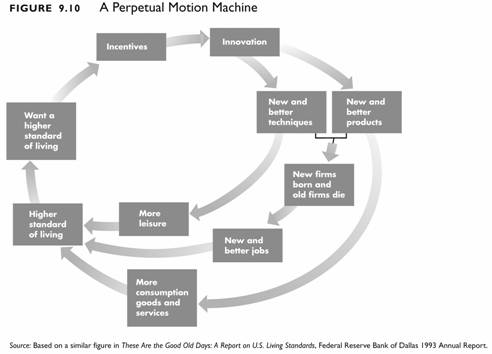

6. Figure 9.9 illustrates the new growth theory in

terms of the productivity curve. Figure 9.10 shows the implied perpetual motion

as a circular flow chart.

MAIN PAGE

ARTICLES PAGE

MACROECONOMICS PAGE

e)

The supply of labor continues to increase until the real wage rate has been

driven back to the subsistence

real wage rate, which is the minimum real wage rate necessary to

maintain life. At this real wage rate, both population growth and economic

growth stop. Figure 9.7 illustrates this process using a productivity curve.

e)

The supply of labor continues to increase until the real wage rate has been

driven back to the subsistence

real wage rate, which is the minimum real wage rate necessary to

maintain life. At this real wage rate, both population growth and economic

growth stop. Figure 9.7 illustrates this process using a productivity curve.