CHAPTER 3 Scarcity. Choice

Test Yourself

1. This question asks the students to apply opportunity cost to a straightforward decision: to rent or buy. After buying the house, the person would no longer have to pay $24,000 annual rent. On the other hand, she would lose the $8,000 she currently earns in interest from her bank account. She would be ahead by $16,000, and the purchase is therefore a good deal. In order to get a service (housing) for which she had been willing to pay $24,000, she only has to give up (that is, the opportunity cost is) goods and services worth $8,000. It is worth pointing out to students that if she did continue to rent the house, it must be because the services she receives from the landlord are worth more than $16,000. Also, it is important to realize that this question is very simplified—it ignores home equity, property taxes, etc.

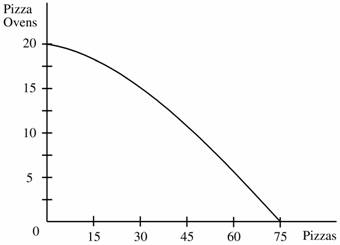

2. Figure 1 shows the production possibilities frontier. The principle of increasing cost holds, because the curve is concave. For example, begin at the point of producing 20 pizza ovens and 0 pizzas. To produce 15 pizzas we must give up the production of 2 pizza ovens; this brings us the point of 18 pizza ovens and 15 pizzas. To gain another 15 pizzas, we must now give up the production of 3 pizza ovens. As we continue to produce more pizzas we must give up increasing quantities of pizza ovens. There are diminishing returns as resources are shifted from pizzas to pizza ovens, or vice versa.

Figure 1 (Pizza numbers are in millions, ovens are in thousands)

3. In case (b), the production possibilities frontier will be further from the origin in 2018, since Stromboli will have more pizza ovens with which it can produce more pizzas.

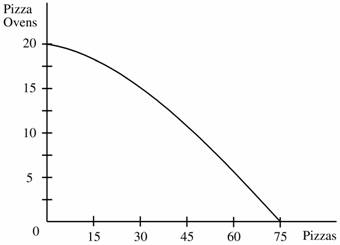

4. Figure 2 shows the production possibilities frontier. It is a straight line rather than a curve, because for each additional box of brand X that Jasmine buys, no matter how many boxes she already has, she must cut her purchases of Brand Y by the same amount, 3/5 of a bag. The production possibilities frontier in this question is really like a budget constraint. Brand X is $0.60, Brand Y is $1.00.

Figure 2

Discussion Questions

1. (a) The poorest person on earth has access to so few resources that she is in danger of perishing. The opportunity cost of any additional good or service is life threatening. For example, if she takes the time to cut and sharpen a stick for hunting, she may not be able to gather the food she needs to stay alive.

(b) Even the richest person in America faces resource limitations. If he buys a shipping company, he will lack the resources to buy an oil company. He is constantly approached for philanthropic donations; he cannot support them all, and if he increases his donations, he may lack the funds to expand into new business ventures.

(c) A farmer in Kansas (or anywhere) has limited resources with which to produce goods, and therefore hard choices to make. If she produces more wheat, she will have to cut back its production of soybeans.

(d) The government of Indonesia has the authority to command the use of a certain amount of labor and other productive resources. If it decides to increase the production of petroleum, it will have to shift some productive resources away from another use, thereby causing the output of coffee, for example, to fall.

3. The answer to this question obviously depends upon the student. Students should be encouraged to think broadly. A student who leaves college would not have to pay tuition and fees, nor the college room and board expenses (on the other hand, these may be paid currently by her parents, so they would not represent a savings to her). She would earn money from a job, but she might have to pay for her own living expenses.

The point to stress is that the opportunity cost of a college education includes indirect items (such as income foregone from a job) as well as costs that the student pays directly.

5. There are countless good answers to this question. An increase in defense purchases, for example, may require a reduction in educational expenditures.