CHAPTER 12 Monopoly

Test Yourself

2. From the data given, one can calculate total revenue, marginal revenue, marginal cost and profit. For convenience, MR and MC per 50,000-gallon unit are shown, although students may choose to calculate MR and MC per gallon:

Output Price TR MR TC MC Profit

50,000 0.28 14,000 14,000 6,000 6,000 8,000

100,000 0.26 26,000 12,000 15,000 9,000 11,000

150,000 0.22 33,000 7,000 22,000 7,000 11,000

200,000 0.20 40,000 7,000 32,000 10,000 8,000

250,000 0.16 40,000 0 46,000 14,000 –6,000

300,000 0.12 36,000 –4,000 64,000 18,000 –28,000

The profit maximizing output is 150,000 gallons, where marginal revenue equals marginal cost. The price charged is $0.22 a gallon, and the total profit is $11,000.

3. The price per 50,000-gallon unit is found by multiplying by 50,000. As the following table shows, for each level of output, marginal revenue is less than price.

Output Price MR

50,000 14,000 14,000

100,000 13,000 12,000

150,000 11,000 7,000

200,000 10,000 7,000

250,000 8,000 0

300,000 6,000 –4,000

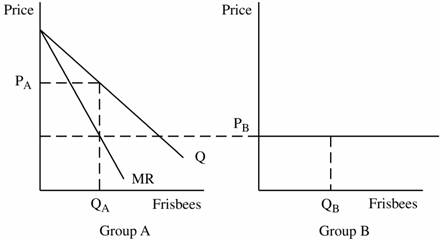

4. Group B has an infinitely elastic demand curve; hence P = MR. Since the firm maximizes profits, it sets output at, for example, QB, where MC = MR. To maximize overall profits, the firm must have the same marginal revenue in both markets, and this must be equal to PB. In Group A, when marginal revenue is equal to PB, the price is higher, as shown, PA.

Figure 1

Discussion Questions

1. There are many ways of discussing this question. For example:

(a) It is obvious that consumers are hurt if they get less output and at the same time have to pay a higher price.

(b) The monopoly’s market power allows it to earn a profit in the long run, that is to say an economic profit, over and above the income that would be necessary to attract the firm into the industry. This is an unnecessary payment or penalty that consumers pay the firm.

(c) The text shows that the price charged by the monopolist is greater than the marginal cost. Therefore marginal utility exceeds marginal cost, and the monopolist is restricting output below its optimal level.

3. Any price increase by the monopolist will result in a reduction in sales, because of the negatively sloping demand curve. When a tax of $24 per item is levied, if the monopolist raises the price by $24, sales will be reduced to such an extent that marginal revenue will exceed marginal cost (even though marginal cost has risen by $24). A more moderate price increase, with a smaller reduction in sales, will allow the monopolist to maximize profits.

4. The highest price a monopolist can charge is the price at which one unit is sold. Sales are so low that profits are low, probably negative. A monopolist wishing to maximize profits will not charge “the highest price which can be got,” but an intermediate price.

7. The gains from exchange are mutual. Firms generate income for themselves, and consumers benefit as well, gaining more in utility than they give up in payment for the goods they buy. If they did not benefit, they would not buy. If a firm is forced to charge uniform prices and as a consequence goes out of business, consumers are denied any benefit at all from buying its products. If it is allowed to discriminate, and as a result continues to exist, consumers will purchase its goods and therefore benefit.